Why Salesforce Commission Calculation Often Goes Wrong

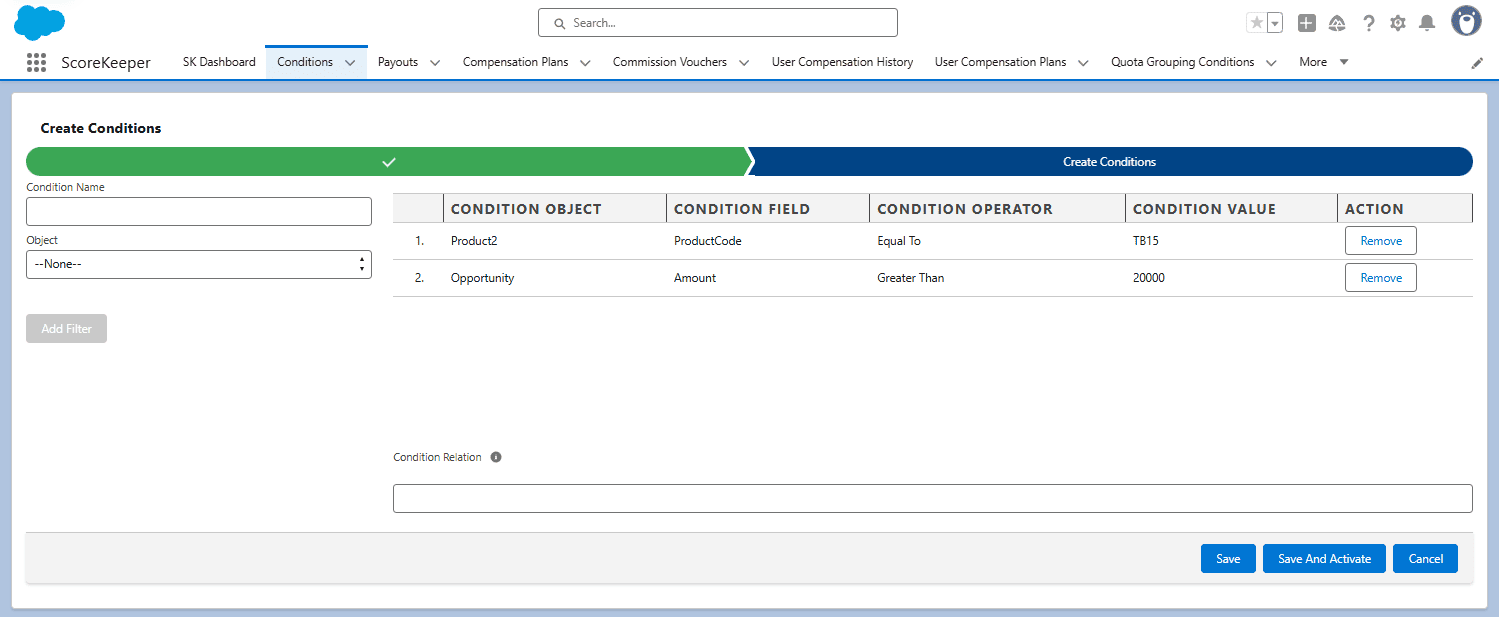

Paying salespeople the correct commission is very important for any business. Even when companies use Salesforce, commission calculations are not always straightforward. Mistakes can happen when rules are set up incorrectly, data is missing, or calculations are done outside Salesforce in spreadsheets or other systems.

For example, imagine a company has several salespeople working in different regions. Some earn a percentage of sales, while others earn based on quarterly sales quotas or recurring revenue. Deals are closed in different currencies: USD, EUR, and GBP. One salesperson in Europe closes a €50,000 deal, but the system uses the wrong currency conversion.

Another salesperson in the US meets their quarterly quota, but Salesforce calculates their commission using the standard percentage rule instead of the quota-based rule. In these cases, some salespeople are underpaid, others overpaid, and the finance team struggles to fix the differences. Mistakes like this create confusion, slow down payouts, and reduce trust in the system.

According to a survey of 153 UK sales directors, 24% regularly saw errors of more than 10% of the total amount of commission paid, and a further 20% said they didn’t even know what errors occurred.

In this article, we will look at the most common errors in Salesforce commissions, provide practical ways to prevent them, and highlight which tools can help you.