What AgentExchange Is and Why This Period Matters

When Salesforce launched AgentExchange in March 2025, it represented a significant step in the company’s journey toward AI-powered innovation. The platform was created to enhance Agentforce, Salesforce’s framework for developing AI-driven agents that operate across Sales Cloud, Service Cloud, and other areas.

In just six months, AgentExchange grew from its launch to a public milestone of 100 listings, achieved one week before Dreamforce 2025. The marketplace emphasizes Agentforce AI components, including prompts, actions, topics, full agent templates, and Apps with AI that function across Salesforce.

Between March and September 2025, AgentExchange progressed through three main stages:

- Launch and experimentation (March–April): partners explored how agentic components could integrate with real business processes.

- Refinement and cleanup (May–July): some listings were removed or updated, demonstrating that the marketplace was curated rather than expanding indiscriminately.

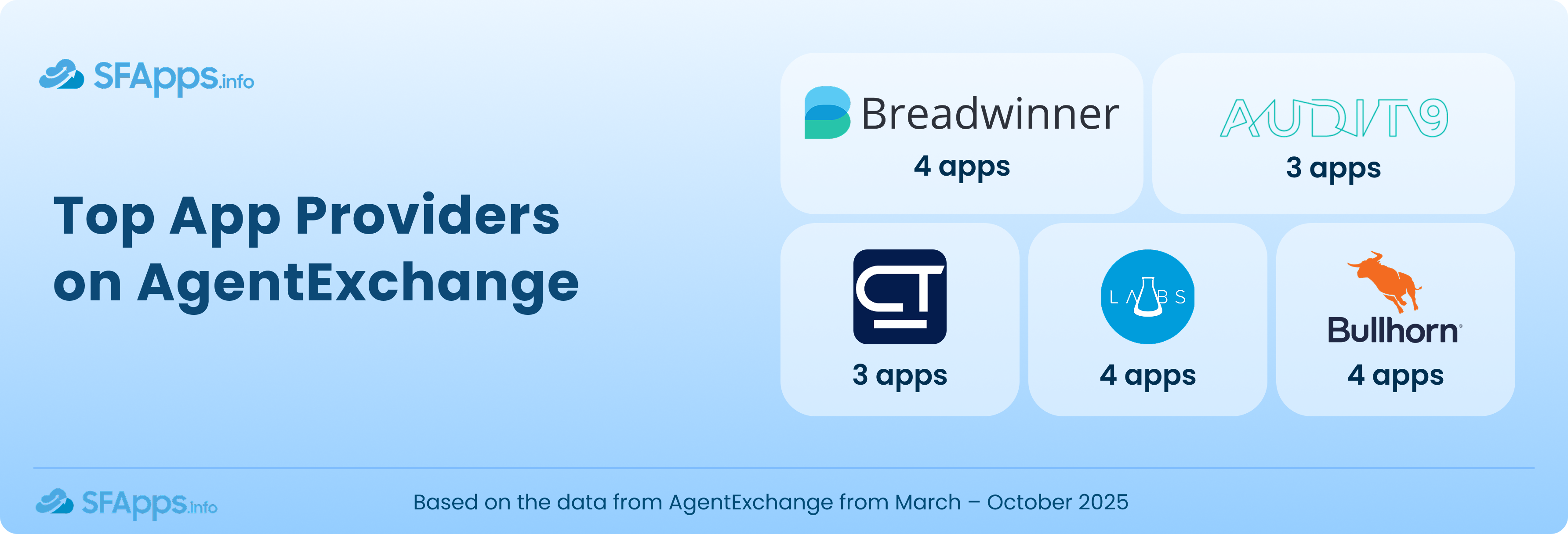

- Acceleration and maturity (August–September): steady additions brought the platform to 114 listings and 96 unique developers, just in time for Dreamforce 2025.

Salesforce’s emphasis on partner-driven AI innovation made this period notable. The company actively encouraged developers to reuse existing capabilities, experiment with native Agentforce tools, and publish functional components rather than prototypes.

This evolution allowed AgentExchange to move from a testing ground to a tangible part of Salesforce’s AI strategy – a place where customers can access working automation modules, not just concepts.