The Missing Link Between Salesforce and QuickBooks

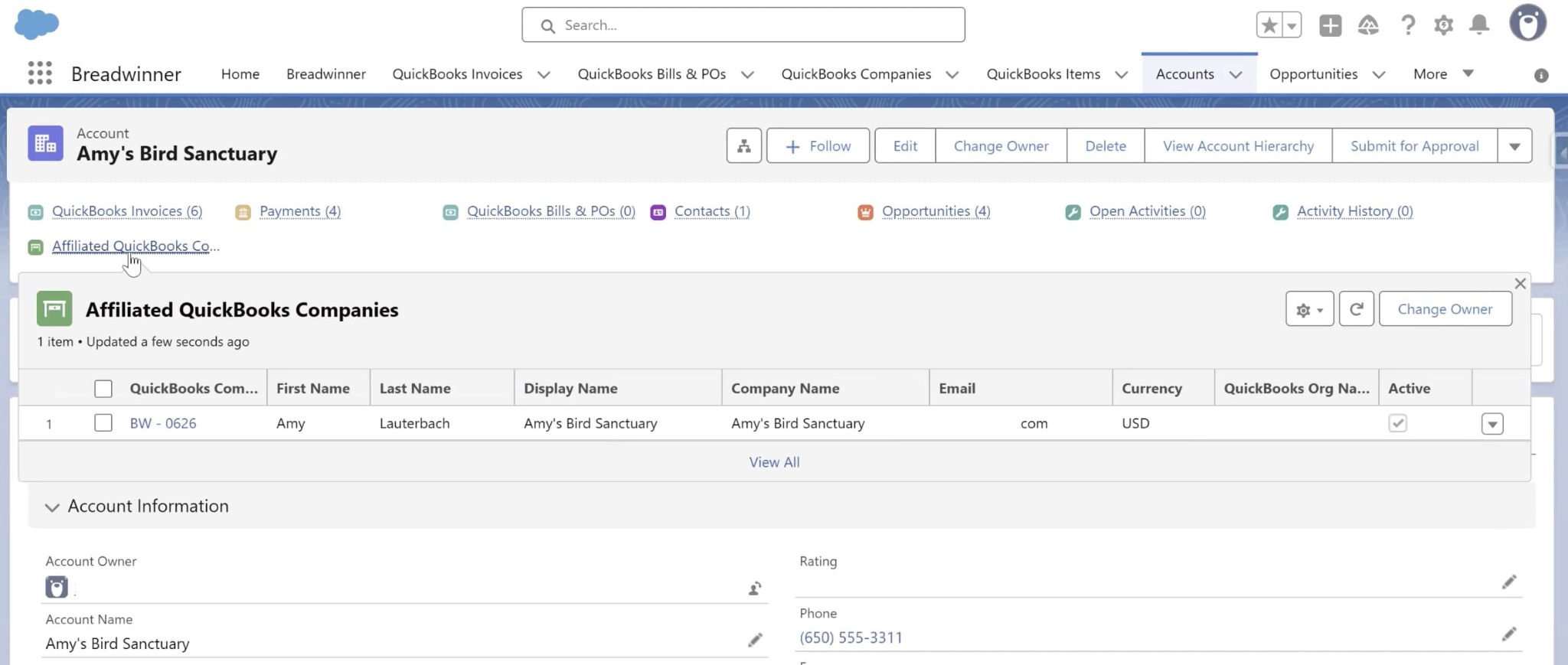

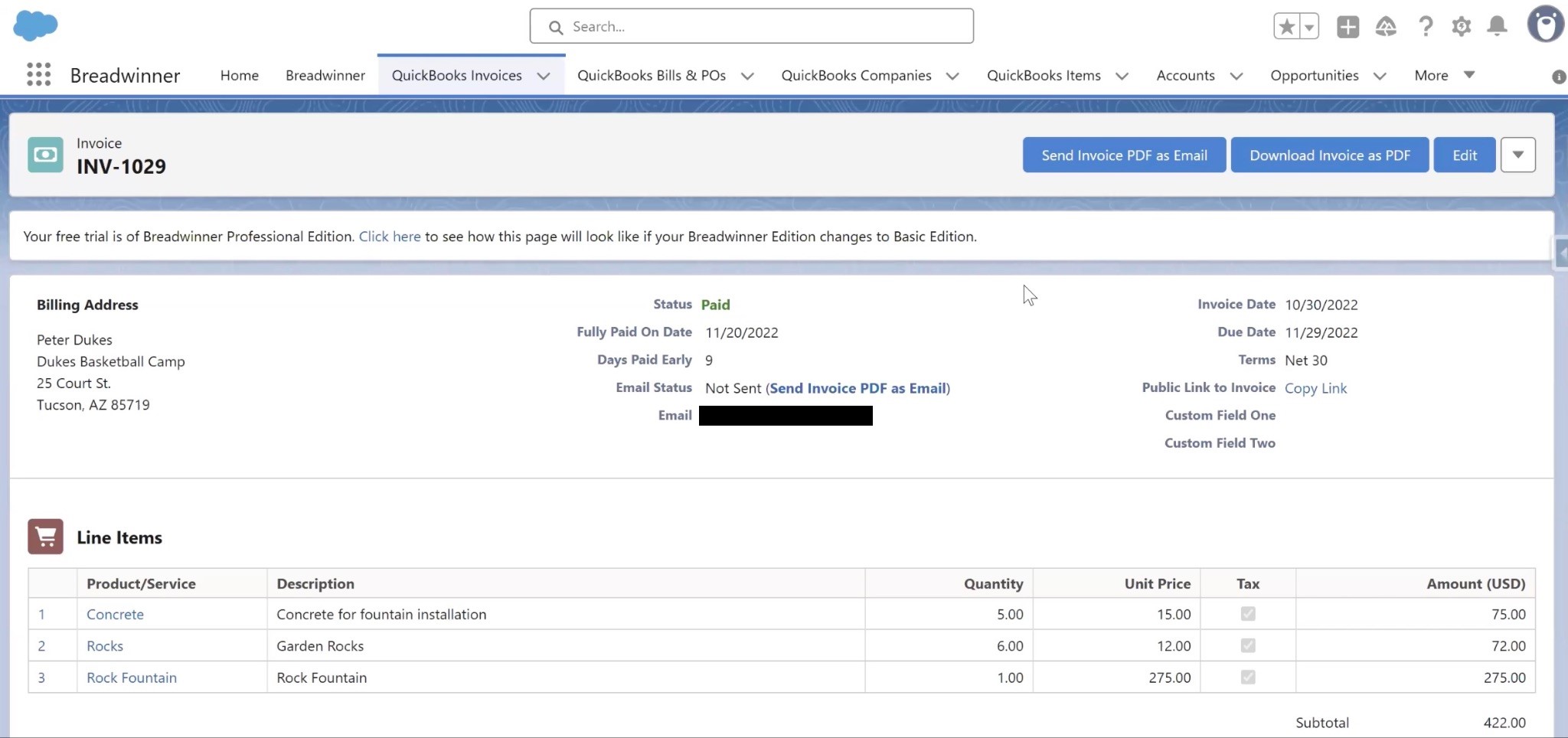

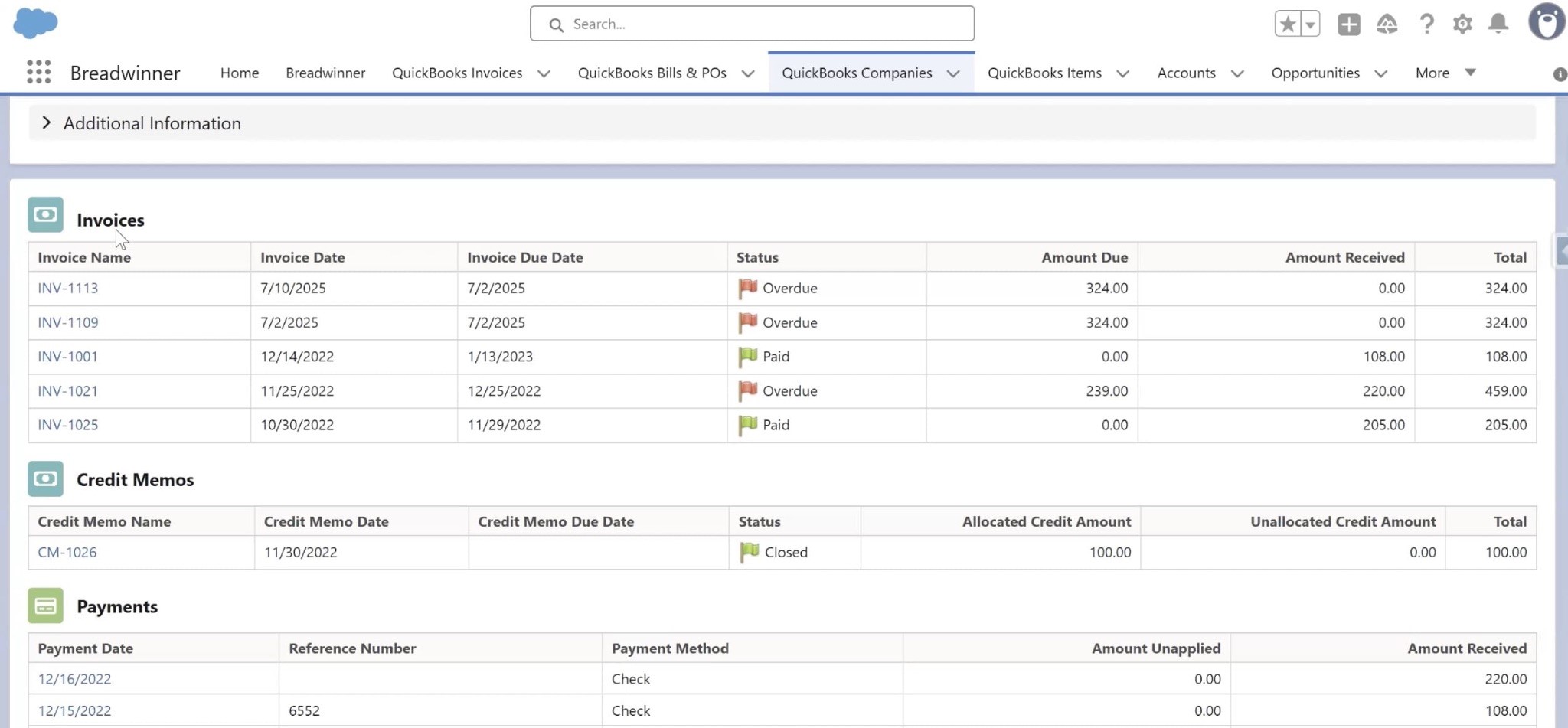

Has your finance team marked an invoice as paid in QuickBooks, but your sales team still can’t see it in Salesforce? It’s a common situation. Finance works in QuickBooks to manage invoices, payments, and expenses, while sales teams live in Salesforce to track deals and customers. When these systems don’t share information, both sides lose time checking updates and correcting numbers.

Imagine a salesperson or account manager calling a customer to ask about an overdue payment, unaware that it was already made last week. Or a finance team preparing end-of-month reports while sales still show unpaid deals. These small disconnects cause confusion, repeated work, and sometimes frustration between teams.

Did you know that most businesses use many different apps, but very few actually work together? While 95% of companies say connecting their software is important for growth, only about 29% of their apps are fully integrated. This means most data still sits in separate systems, and teams often spend extra time moving information between them.

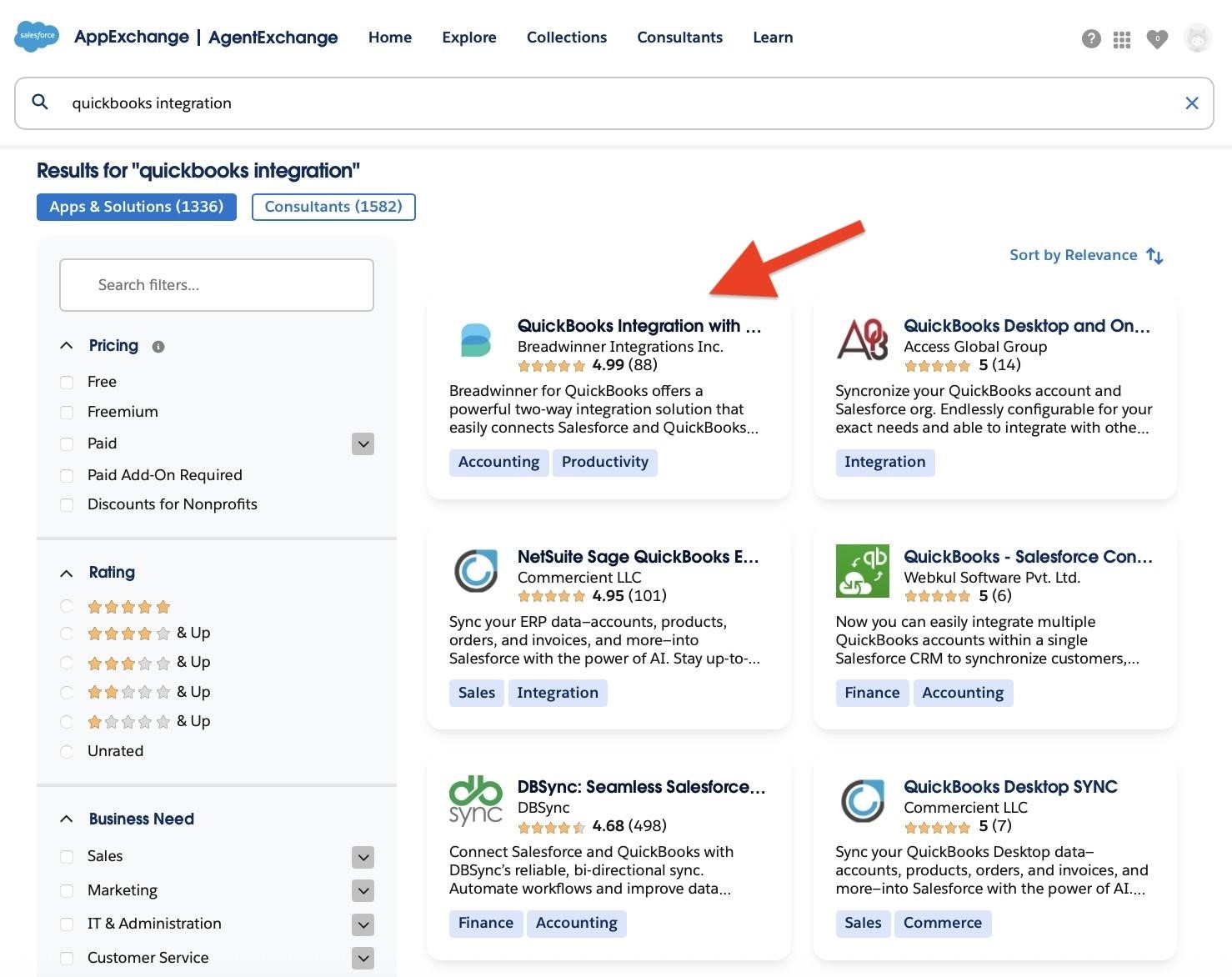

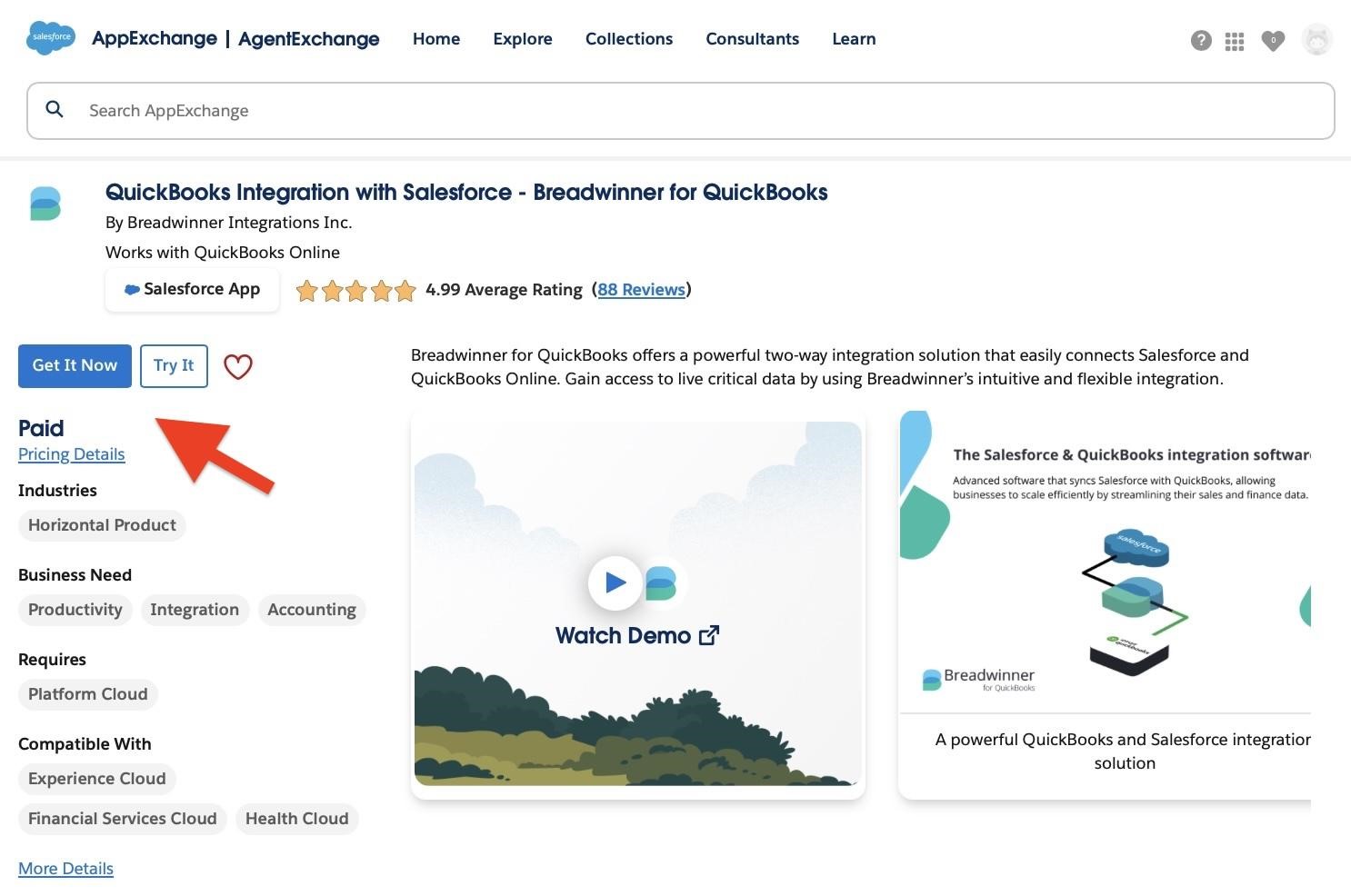

QuickBooks online integration with Salesforce solves this. Once linked, payment details, invoices, and customer data move automatically between both systems. Sales can see up-to-date payment status right in Salesforce, and finance can rely on accurate records without chasing updates.

This article explains how the integration works, what to expect during setup, and the best ways to keep both systems aligned and reliable over time.